ZAKAT FUND ABU DHABI

Zakat is an obligatory charity or almsgiving in Islam, which is one of the five pillars of Islam. Zakat is considered to be a form of worship and is mandatory for all Muslims in most countries. Giving away money to the poor is said to purify yearly earnings that are over and above what is required to provide a person and their family with their essential needs. The Zakat Fund is an organization that collects and distributes Zakat to those in need. This article will provide information on what the Zakat Fund is all about.

What is the Zakat Fund?

The Zakat Fund is an organization that collects and distributes Zakat to those in need. The Zakat fund is an important part of the Islamic financial system and is considered to be a mandatory type of tax. The Zakat Fund is usually run by the government or a non-profit organization, and it is responsible for collecting Zakat from those who are obligated to pay it and distributing it to those who are eligible to receive it.

Zakat al-Fitr is another form of Zakat. This is the Zakat of Fast-Breaking, which is paid at the end of the holy month of Ramadan. It is also called Sadaqat al-Fitr, “the Charity of Breaking the Fast” of Ramadan. The amount to be paid as zakat fitrah is 2.5 kg, or 3.5 liters, of rice per

person. Zakat Al Fitr needs to be paid by every Muslim, and it can be paid directly to someone you know who is poor or needy or through registered organizations in the UAE.

History of the Zakat Fund:

The name Zakat Fund comes from the Arabic word “Zakat,” which means “purification.” Zakat is a form of charity that is meant to purify the wealth of the giver. The word “fund” refers to the organization that collects and distributes Zakat. It was established by Sheikh Zayed bin Sultan Al Nahyan, the Founding Father of the UAE.

Zakat has played a major role in the history of Islam and has led to disputes, notably during the Ridda wars. Zakat is considered to be a mandatory type of tax, although not all Muslims abide by it. In many countries with large Muslim populations, individuals can choose

whether or not to pay zakat.

How is Zakat calculated?

Zakat is an Islamic finance term referring to the obligation that an individual has to donate a certain proportion of their wealth each year to charitable causes. Zakat is calculated based on the value of an individual’s assets, including cash, gold, silver, and other valuables. The value of debts and liabilities is subtracted from the total value of assets to determine the net worth. If the net worth is above a certain threshold, then 2.5% of the net worth is paid as zakat.

The recipients of Zakat are the poor and needy, the destitute, those in debt, and the wayfarer. The Zakat fund is distributed to these recipients in the form of food, clothing, shelter, and other basic necessities. The fund is also used to provide education, healthcare, and other essential services to those in need.

What is the purpose of the Zakat Fund?

Zakat is a religious obligation for all Muslims who meet the necessary criteria of wealth to donate a certain portion of their wealth each year to charitable causes. The poor and indigent make up the top priorities of Zakat, and these are the people in desperate need that organizations

focus on distributing Zakat to. The purpose of Zakat is to create balance in society and never let a poor and needy person suffer or die. It is a religious obligation for all Muslims who meet the necessary criteria of wealth to donate a certain portion of their wealth each year to charitable causes. The basic objective of paying Zakat is to maintain economic balance in society so that the circulation of wealth continues from rich to poor and never stays in one hand. Zakat helps keep the economy flowing by freeing people from burdens and giving them the chance to reach their potential. Zakat is also a means to increase faith and devotion to Allah (God) and acts as a social safety net for those in need. It is a way of upholding and strengthening the religion and works together with the other four pillars of Islam. By giving Zakat, Muslims cleanse their own wealth and purify their yearly earnings that are over and above what is required to provide a

person and their family with their essential needs.

How to apply for Zakat?

- Request an appointment in Zakat Fund’s website

- Login with UAE Pass

- Start the service

Pay your Zakat online (Zakat Payers)

- Visit Zakat Abu Dhabi Website

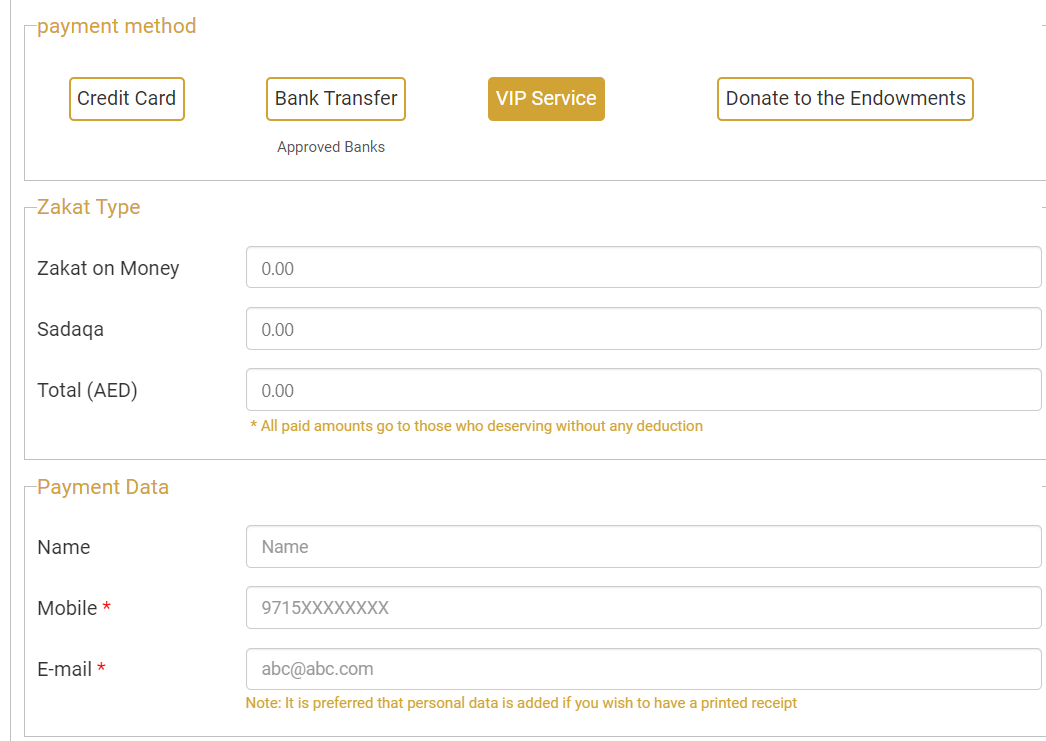

- Customers have the option to pay using credit card, bank transfer (You can see the approved banks below), VIP service, Donate to the Endowments

Zakat fund Approved Banks

- Abu Dhabi Islamic Bank

- Abu Dhabi Commercial Bank

- Ajman Bank

- Arab Bank

- Barclays Bank

- Citi Bank

- Commercial Bank International

- First Abu Dhabi Bank

- HSBC Middle East

- Standard Chartered Bank

- United Arab Bank

- Commercial Bank of Dubai

- Islamic Bank of Dubai

- Emirates NBD

- Mashreq Bank

Conclusion:

The Zakat Fund is an important part of the Islamic faith and plays a significant role in helping the poor and vulnerable. It is an important part of the Islamic financial system and is considered to be a mandatory type of tax. In many countries with large Muslim populations, individuals can choose whether or not to pay Zakat. However, in most Islamic countries, Zakat is mandatory, and failure to pay can result in penalties. Thus, the Zakat Fund is an important part of the Islamic faith and plays a significant role in helping the poor and

vulnerable.